Daily Gold Market Prices at ALLU

It is critical to check the market price of gold daily to sell at a high price. At ALLU, we keep a daily watch on the market trend of gold and other precious metals and update our prices accordingly. Due to the fluctuating global conditions and dollar-yen exchange rate upon which the price hinges, gold’s market value constantly changes at a fast pace. We believe that the price of gold will settle in the future, and there is a chance that today’s price will be the highest. At our store, we buy various types of gold products, including 24 karat gold ingots and coins, Kihei necklaces, 18 karat accessories, and more.

Gold and Precious Metals Market Price

*Updated:

Daily Market Price *Per Gram

| Gold K24 |

$ ($)

|

|---|---|

| Platinum |

$ ($)

|

| Silver |

$

|

Gold Market Price

| K24 |

$

|

K14 |

$

|

|---|---|---|---|

| K22 |

$

|

K10 |

$

|

| K21.6 |

$

|

K9 |

$

|

| K20 |

$

|

K18WG |

$

|

| K18 |

$

|

K14WG |

$

|

Platinum Market Price

| Pt1000 |

$

|

Pt900 |

$

|

|---|---|---|---|

| Pt950 |

$

|

Pt850 |

$

|

Silver Market Price

| Sv1000 |

$

|

Sv925 |

$

|

|---|

Gold and Platinum Combination

| Pt900 / K18 (50-50) |

$

|

Pt850 / K18 (50-50) |

$

|

|---|

Gold Market Price Chart

K24 Ingot (Per Gram)

| Month/Day | Selling Price | Diff. Previous Day |

|---|---|---|

|

{{formatDate(table.prices[index].date)}} |

$

{{formatPrice(table.prices[index].price)}} |

$

{{formatDiff(table.diffs[index])}} |

Gold Market Price Simulation

Grade

Weight

Market Selling Price

- - Precautions Regarding Selling Gold and Precious Metals -

- *If the item's grade is unknown, we may ask you to leave the product with us temporarily to allow us to examine it accurately.

- *Due to the influence of the gold and platinum market, prices may fluctuate even within the same day.

- *Once sold, items will not be returned.

How to Sell Luxury Goods at ALLU

What We Buy at ALLU

- Gold and Precious Metals

- Watches

- Brand Bags

- Brand Wallets

- Jewellery

- Accessories

- Antiques

■ Items You Can Sell

Bags, pouches, tote bags, business bags, boston bags, clutches, travel bags, shoulder bags, wallets, card cases, passport holders, key cases, wristwatches, mules, sandals, oxfords, pumps, boots, pair rings, rings, necklaces, pendants, piercings, earrings, brooches, bracelets, gloves, belts, pens, wrist bands, anklets, accessories, eyewear, hats and caps, handkerchiefs, neckties, stoles, scarves, bangles, etc.

Luxury Articles We Buy Back

Watches, jewelry, bags, wallets, accessories, clothing, shoes, antiques, gold and precious metals. For other items, please contact us for details.

ALLU Offers Much More than High Selling Prices!

Reliable, credible, and trustworthy appraisals

Our staff undergo thorough training under the tutelage of specialists in various fields, such as watches and jewellery, that allow us to provide the most accurate, detailed, and credible appraisals. We conduct periodic in-house tests to ensure our employees maintain their expertise and develop new skills. As professionals, we constantly strive to improve our skills to provide the most competitive appraisals.

Focus on providing high-quality customer service

We make the selling process as simple as possible, and our staff ensures that our customers understand and are satisfied with each appraisal.

We purchase a wide variety of items and brands

We cater for an extensive range of items and brands and actively consider items in all conditions, even items our competitors may refuse to buy.

No selling quantity or price limits

For customers with large amounts or significantly expensive items, we buy and pay on the day without any limits in quantity or value.

Quick and easy appraisals

Through our expert proficiency and globally vast product data collection, we provide speedy appraisals with minimal waiting time.

Stress-free and private spaces

We strive to create the most stress-free selling experience with store spaces designed to ensure comfort and privacy.

Conveniently located stores

ALLU stores are located in central areas for convenient access. Feel free to stop by while shopping or on the way home.

Shop Information

ALLU HK Causeway Bay Shop

Room A2, 16/F ,Emperor Watch And Jewellery Centre, 8 Russell St, Causeway Bay

Central Shop

18/F, Stanley 11, 11 Stanley St, Central, Hong Kong Island, Hong Kong

ALLU HK Jordan Shop

Room 503-4, 5/F, Hanford Commercial Centre, 221B-E Nathan Road, Kowloon

ALLU HK Kwun Tong Shop

Room 1802, 18/F, One Pacific Centre, 414 Kwun Tong Rd, Kwun Tong

You Need to Show Valid Identification to Sell at ALLU!

- Hong Kong Identity Card

- Passport

- Only one of the above forms of identification is required.

- We can not buy items from customers under the age of 18 years old.

- We do not accept identification documents that are expired or out-of-date.

- Corporate customers follow the same selling process as individual customers. No additional documentation is required.

Sell Your Gold, Platinum, and Silver at ALLU

Gold by Grade

Gold by Colour/Type

Gold by Accessories

Other Gold Items

Platinum by Grade

Other Platinum Items

Gold and Precious Metal Market Prices

We also purchase other gold, platinum, and silver items than those listed above. We welcome all items, even from 1 gram!

Important Facts About Gold and Precious Metal Market Prices

How is the Gold Market Price Decided?

As you may know, there is an increasing number of accessories and jewellery made with gold in the market. Rings, bracelets, and earrings are available in a wide variety of styles: some in pure gold, some plated with K14, with various degrees of purity — recently, items made with K18 or other kinds of coloured gold are increasingly popular. There are many different types of gold products, but all of them have one characteristic in common: the higher the purity of the gold, the higher the value. And this value is determined by the "gold market." The gold market influences the price of all gold products: not only accessories and jewellery but also bullions, typically known as gold bars, commemorative gold coins, bullion-type gold coins, and financial instruments made of gold. The gold market influences the price of all these products.

How does the gold market truly function, though? Why does the value of gold fluctuate?

Here, we will illustrate basic knowledge about the gold market. If you follow us until the end, the mechanisms behind the value of gold will become clearer!

The Gold Market has a Dual Structure

The price of gold changes every day: what determines it is the relationship between supply and demand. While stock prices rise and fall for investment purposes, the mechanisms of the gold trading market are slightly more complex. The increase in the supply of gold is due to mining companies increasing the amount of gold mined and an increase in the distribution of second-hand scrap gold. On the other hand, demand has a double-layered nature: one is for investment purposes, and the other is for use in manufacturing. This is because gold can be used as a raw material and also circulated as an asset. The balance of such supply and demand is what determines the value of gold day after day.

The Market Determines the Value of Gold

Because of this dual structure, there are two markets for gold: the spot market, where physical gold is bought and sold, and the futures market, where gold is traded. Just as there is a stock market for buying and selling stocks, gold is traded through the market. The four major gold markets are London, Zurich, New York, and Hong Kong, while other gold markets include Tokyo and Shanghai. The London market, in particular, is said to be the largest market for physical gold trading and is the standard for the world gold market. The New York and Tokyo markets are also known as important futures markets. Gold purchased at a gold store is refined, melted, and processed into bullion, which is eventually traded on the physical gold market. Therefore, the purchase price of gold at a gold store is based on the market price of the physical market.

How to Check the Gold Market

In Japan, for example, Tanaka Kikinzoku Kogyo — which handles physical gold — announces the price of gold in the physical market every morning at 9:30 (the price can also be checked on their website). More precisely, this value is the price of a bullion. In other words, it is the price of a bar of pure gold (99.99% or higher purity). Although bullion dealers deal in physical gold, they import gold from overseas markets, so the price of gold is affected by overseas gold prices and foreign exchange markets. Not only the physical gold market but also the futures market quotations are publicly available. At the Tokyo Commodity Exchange, gold is traded on the futures market. These futures prices are also published on the TOCOM website and can be checked by anyone.

What Kind of Companies Publish Gold Prices?

Only some companies make it easy to trade gold. Since anti-counterfeiting and uniformity of purity are very important, only a limited number of companies trade in gold. Bullion dealers, mining companies, banks, and companies that operate futures markets: only very few companies handle gold trading with a high degree of reliability. The trading prices of companies accredited by the London Bullion Market Association (LBMA*1), such as Tanaka Kikinzoku Kogyo, Mitsubishi Materials, and Tokuriki Honten, are referred to as the gold market prices. Nevertheless, the OTC price of gold differs slightly for each company. This is because each company determines its own gold trading price independently. *1 The LBMA registers companies and mints as accredited melters, setting standards for precious metals to be traded on the London precious metals market. Bullion from accredited companies can circulate on the bullion trading market as a global standard.

Products Affected by the Gold Market

The gold market affects the price of all gold products: not only products in pure gold, but other products may change accordingly if they contain gold. This is because, while there are countless manufacturers of gold products, they all purchase gold as raw material at a price determined by the gold market. In other words, if the gold market price changes, the price of raw materials for gold products will change accordingly. Naturally, every manufacturer makes an effort to stabilize the price of its products. Still, when the gold market fluctuates wildly, the manufacturer must also change the price of its gold products. In short, all manufacturers follow the same gold prices, so if the gold market changes, the prices of all gold products may change. If the gold market changes, for example, the prices of rings, earrings, bracelets, pendants, watches, fountain pens, bracelets, etc., may all change. The same applies to the price of bullion (*2), bullion-type gold coins (*3), commemorative gold coins, and other commodities. Not only that, but the prices of financial instruments linked to the price of gold and the price of gold on margin, known as paper gold, are also likely to change. *2 Bullion is also known as ingots or gold bars. It is not only processed for easy storage but also stamped. Bullion bars in circulation fill the requirement of 99.99% or higher purity. Their weight may vary: some weigh as much as 1 kilogram, and others (named "small bar") are lighter. *3 Bullion-type gold coins are not the kind of commemorative gold coins that collectors collect but are gold coins made primarily for investment purposes. They are not only in pure gold coins, but also K22 coins are in circulation. Although most of them are circulated for small investments, many have beautiful designs and are popular among collectors.

Characteristics of Gold Market Fluctuations

With stocks, for example, it is not unusual for the value to increase tenfold in a few years. In comparison, the market price of gold is much more stable. Over several years, however, it fluctuates due to a variety of factors: observed in a long-term span of 10 years, it shows to be gradually growing. In 2001, the price of physical gold was stable at around 1,100 yen per gram. In 2015, however, the price was moving up and down in the range of 4,200 yen to 4,800 yen. A variety of factors on the supply and demand side can alter the gold market price. We will explain each of them below.

Factors that Affect the Gold Market Price: Insufficient supply

The lower the supply of gold, the more scarce it becomes, and consequently, its value increases. It is said that the total amount of gold mined by humans over the past 6,000 years will soon reach 200,000 tons: almost four official Olympic swimming pools worth of gold. However, there is no guarantee that this much gold will continue to be mined. Unfortunately, only about 70,000 tons are said to be left as reserves. The total annual supply of gold is approximately 40 million tons: of that amount, about 10 million tons are gold scrap, and the production of new gold from mines is about 30 million tons. Moreover, in the last ten years, the amount of gold mined has increased by about 5 million tons. Considering the amount of gold reserves, at this rate of mining, the world would run out of gold after 30 years of digging. Of course, it is possible to use second-hand gold, and if new gold mines are discovered, or mining technology improves, more gold could be mined. However, if the level of technology does not change, the supply of gold will reach a plateau.

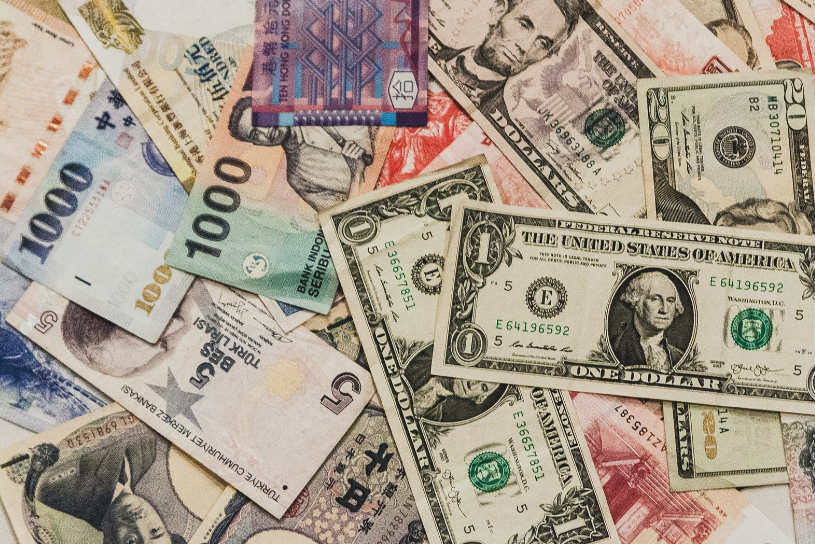

Factors that Affect the Gold Market Price: Currency Value

Inflation caused by monetary easing and other economic policies can easily increase the price of gold. Inflation basically means a decrease in the value of a country's currency. For gold denominated in dollars, the question for the market is how many grams of gold can be exchanged for one dollar. For example, if the U.S. central bank issues a significant quantity of dollars as a result of its economic policies. This would result in more dollars, making the dollar lose relative value. When the dollar's value falls, the value of real assets that can be exchanged for dollars rises. This is the case with oil, for example, but naturally, gold is a real asset as well, so its price will rise in this way. Furthermore, after the Plaza Accord of 1985, which was reached to correct the dollar's appreciation, the dollar's value fell, and that of gold rose.

Factors that Affect the Gold Market Price: Incidents and Emergencies

Political Instability If international conditions deteriorate, economic problems will increase, such as an inability to trade. When this happens, a country loses credit. That country's stock market will stagnate, and its currency will also lose credit. The deterioration of the international situation increases the risk of a country falling into a credit collapse. At such times, more and more people seek to own gold, and the market price of gold tends to rise. In 1979, the year of the Iranian Revolution and the Soviet invasion of Afghanistan, there was a lot of unrest also due to the peak of the Cold War. Gold prices rose sharply at that time. The value of gold then gradually declined, but in 1982, the Mexican debt crisis and the Falklands War between the United Kingdom and Argentina caused the gold prices to jump again, as happened also after the 9/11 terrorist attacks. In each of these situations, the price of gold rose because of the desire to protect one's own assets from unsettling international events. Financial Instability Financial instability can also raise the market price of gold: In August 2007, the subprime mortgage problem came to light, followed by the Lehman Brothers collapse and other global financial problems. At the time, gold prices rose as well. Since gold is considered a safe asset, more people want to own gold to protect their assets from credit risk.

Factors that Affect the Gold Market Price: Stagnant Stock Market

The price of gold rises even when the stock market is stagnant. In other words, gold prices rise when the stock market is low. The reason is that when stocks' popularity declines, money that would have originally been invested in stocks is invested in gold instead. When deflation causes economic instability, the stock market can stagnate, and gold demand can increase. Thus, trends in the stock market influence investors' investment plans, which in turn affects the gold market.

Factors that Affect the Gold Market Price: Exchange Rates

Since Japanese bullion dealers import gold from overseas, the exchange rate affects the gold market price in Japan. Specifically, the dealers receive purchase orders for gold in Japan and purchase that quantity from overseas suppliers. The gold price in Japan is thus affected by the exchange rate: if it changes and the yen appreciates against the dollar, the price of gold in yen becomes higher. Let us briefly explain what that means. Examples of Foreign Exchange Impact First, let us assume a 100 yen = 1 dollar exchange rate so that 10,000 yen can be exchanged for 100 dollars. Then, that $100 can be exchanged for 1 kilogram of gold. At this point, 10,000 yen can be exchanged for 1 kilogram of gold; however, suppose that the yen appreciates against the dollar and 100 yen = 2 dollars. In this case, 10,000 yen can be exchanged for 200 dollars, and 200 dollars can be exchanged for 2 kilograms of gold, so in the end, 10,000 yen can be exchanged for 2 kilograms of gold. In other words, the price of 1 kilogram of gold was originally 10,000 yen, but due to the strong yen and weak dollar, 2 kilograms of gold is now 10,000 yen. The strong yen against the dollar makes gold cheaper. In this way, exchange rates affect the gold market.

Factors that Affect the Gold Market Price: Interest Rates

When gold is considered an asset, it is basically classified as an asset that does not pay interest or dividends. In other words, it is an asset more about being protected than invested. Although some investment methods produce income, gold usually does not earn interest. This characteristic affects the market price of gold; specifically, the price of gold tends to rise when interest rates on bank deposits, government bonds, and other credits fall. The reason is that when interest rates on bank deposits and government bonds fall, there is less benefit to investing in them, and the relative value of gold as an asset increases. Conversely, when interest rates rise, the demand for assets that can also earn interest increases and the price of gold decreases. When interest rates are high, it becomes possible to earn more through interest. At such a time, fewer people go out of their way to buy interest-free gold, so the price of gold goes down.

Factors that Affect the Gold Market Price: Investment Booms

When investment booms occur, investment in the stock market also increases, but gold is sometimes purchased to mitigate risks. Moreover, recently, more and more investors are investing in gold not only as a real asset but also as a new financial instrument. Not only steady investments, such as pure gold accumulation but also new financial products that apply financial theory, such as gold ETFs, have been introduced. Unlike investments involving risk or requiring specialized knowledge, such as gold futures trading and gold CFDs, gold ETFs are financial instruments that relatively anyone can invest in. Compared to other investment methods, investing in relatively small amounts is possible. Recently, the government has even introduced a tax exemption system to encourage individuals to invest, and gold investment is no exception. Thus, more and more people around the world are investing in gold. More people will seek to own gold, a resource that has been scarce from the beginning. The gold market price is likely to soar even higher in such a situation.

Factors that Affect the Gold Market Price: Speculation of Investment Institutions

Gold is not only traded in physical form: there is also margin trading due to speculation. In the physical market, the price is primarily determined by the value of physical gold itself, but in the futures market, the price is also influenced by speculation. In paper certificate trading in the futures market or in gold ETFs, the object of the transaction is sometimes referred to as paper gold since this means that credit is being traded instead of physical gold. Large quantities of gold can be traded because of leverage in the futures market. If investment banks, hedge funds, and other large institutions dump gold futures in large quantities, it will also crash the gold bullion market. Speculation in the financial industry also affects the physical market price. If margin trading in these futures markets were to run out of control without the backing of physical gold, it would significantly impact the price of physical bullion.

Factors that Affect the Gold Market Price: Increase in Consumption

The popularity of smartphones and personal computers continues to increase worldwide, and such devices always use gold. Gold is a material that conducts electricity easily and is not easily damaged by harsh environments such as high heat, high voltage, and acids. Moreover, it is also used as a catalyst — a medium that aids chemical reactions. Gold is also a necessary material for batteries in electric vehicles, which are likely to become increasingly popular. It can also be used as an ink if it is finely processed. Thus, the more science and technology progress and the consumption of gold increases, the more it becomes a necessary material for international society. As technological innovation progresses worldwide and consumption in developing countries increases, the demand for gold will increase, and prices will rise accordingly.

"Brexit" Issue Also Raises Gold Prices

Recently, you have undoubtedly heard of the issue of the United Kingdom's exit from the European Union. As soon as it was learned that the majority of the people in the U.K. voted to leave the E.U., the value of the British currency, the pound sterling, fell. At the same time, the price of gold denominated in pounds sterling rose. A weaker currency increases the price of gold, which is to be expected. Other factors besides the weak pound drove the gold price higher: the U.S. Federal Reserve Board postponed an interest rate hike to avoid financial market turmoil caused by the U.K.'s exit from the European Union. When interest rates do not rise, the relative attractiveness of gold as an asset increases, and thus the gold price rises. Therefore, the overlapping currency value and interest rate issues affect the gold market.

Understanding the Gold Market - Summary

The gold market determines the price of all products made of gold. There are two types of gold markets: the physical market and the futures market. Gold has value as a raw material and as an asset. The balance between supply and demand determines the price of gold in the market. If the scarcity of gold increases due to a shortage of supply, the price of gold will rise. In fact, the price of gold will only increase in the long run. Since gold is a limited resource, we can say that the present day is the most scarce time for gold. Various demand-side factors affect the gold price. Increased consumption in developing countries and advances in science and technology causes an increase in the demand for gold. In addition to the value of gold as a physical commodity, the value of gold as an asset can also cause significant changes in the gold market. If a currency's value changes due to monetary easing or an agreement on currency exchange, the price of gold will change accordingly. This is because the exchange ratio between gold and the currency changes. In addition, gold purchased in Japan is imported, which is another reason why the exchange rate affects the gold market. Gold is also known as "contingency gold," as demand increases when political or financial instability occurs. When society is unstable, the price of gold tends to rise. Perhaps for this reason, central banks in China, Russia, and other countries are increasing their gold holdings rapidly. Other factors that can change the gold market include speculative money movements. Trends in the stock market and interest rates can change the gold market, and speculation by hedge funds can also change the gold market. Recently, there has been an increase in financial instruments such as gold ETFs as well as gold futures investments. Margin transactions such as paper gold can also affect the physical market. As financial markets become more complex, so will the gold market's movements become more and more complicated. The fact that the gold market has many faces proves gold is so active. Visit ALLU to Sell Your Gold and Precious Metals Here at ALLU, we evaluate not only the market price of gold but also its value as a product. We can purchase high-valued gold products that are difficult to resell in their original condition, such as jewellery in poor condition. We purchase gold products of all purities, including 24k gold (K24), 22k gold (K22), 20k gold (K20), 18k gold (K18), and 14k gold (K14). We also deal in silver and platinum products. If you want to sell your precious metals, such as gold, silver and platinum, please take advantage of our services at ALLU.

ALLU Frequently Asked Questions

How do you decide the selling price of gold, platinum and other precious metal accessories?

We measure the items you bring to us and derive the appraisal value based on the market price x weight. However, in some cases, if the item possesses an exceptional design as jewellery, we may consider the additional value.

My gold/precious metal does not have any engravings. Can I still get it appraised and sell it?

Can I sell broken items such as broken necklaces, rings with missing stones, or earrings with one pair missing?

How long does it take for an appraisal at the store?

Do scratches and stains affect the selling price?

In the case of ingots, depending on their condition, they may be treated as scrap, which may significantly affect the selling price. For other precious metal products, we will have to actually observe the item in question before making a decision.

Can I sell old coins and foreign gold coins?

Some commemorative and foreign gold coins have a premium value, as they are hard to obtain due to their small circulation. If you bring such gold coins to us, they may be worth more than ordinary precious metals.

When is the best time to sell gold and precious metals?

However, the market price of gold and precious metals fluctuates daily, so it is very important to notice the timing when the market price is high.

Is the selling price different for ingots and gold jewellery?

Ingots have their own values and prices: we can make an offer at the ingot price if the brand is recognised in our regulations. On the other hand, even if it is 24-karat gold, gold jewellery is treated as scrap, so that the price will be slightly lower.

Is there a difference in selling price between ingots with and without engraving?